Outdated Processes Lead to Profit Loss

Inefficient practices hinder organizations, leading to unnecessary delays and misinformed decision-making. For example, reliance on manual data manipulation or analysis within spreadsheets can compound errors, impacting budget allocations, project timelines, and overall profitability.

Taking Shots in the Dark

Organizations with poor visibility into product budgets, expenses, and revenue cannot accurately make real-time decisions. Consequently, they operate blindly, unable to address feedback until post-production.

Inflexibility Kills the Competitive Edge

In the face changing market conditions or unforeseen challenges, inflexible processes impede any organization’s agility and innovation. Delayed responses can leave an organization stuck and vulnerable to disruptions and missed opportunities.

Negative Employee Impact

Complex financial processes put an unnecessary burden on employees. For example, employees may be required to work overtime to reconcile data in multiple platforms, manually reconcile spreadsheets, or manually create tedious financial reports. Frustration stemming from inefficient processes can contribute to burnout.

Growing Pains

As companies adopt new Agile ways of working, collisions with existing methods can cause additional tensions.

As companies adopt new Agile ways of working, collisions with existing methods can cause additional tensions.

For example, a common source of friction exists between the finance team, who operate under a traditional funding model, and staff that work under Agile methodologies. Often, the finance team wants to structure the breakdown of work based on traditional waterfall methods. However, Agile practices rely on a flexible and continuously changing backlog of work, which can be difficult to quantify. Valuable time is spent debating processes, and lack of understand can result in a frustrating stalemate. Either the finance team dictates the process, and teams become less Agile. Or, the Agile teams achieve their ability to operate under leading-practice Agile principles, and the finance team struggles to obtain their needed data. There is a better way! (Keep reading!)

Add more hours to the same tasks without evaluating the methodology.

Ignoring underlying issues, employees may be required to work longer hours or take on more responsibilities to compensate for system inefficiencies.

Switch the entire business funding model overnight.

In a desperate attempt to enact swift change, some organizations may opt to overhaul their entire funding model without proper planning or consideration of the implications.

These approaches eventually fail because:

- Failure to understand and address underlying issues cannot be remedied simply by working longer hours or implementing unsupported changes to funding models.

- Merely extending the duration of efforts without reevaluating the strategy perpetuates a cycle of diminishing returns.

- Abrupt changes without proper planning may lead to confusion, employee resistance, and disruptions to business operations, potentially resulting in financial instability.

- Employee resistance to change can undermine any attempted remedies, especially if staff perceive changes as unnecessary or poorly communicated.

- Lack of training and support can hinder employees’ ability to adapt to new processes.

Business Value:

Streamlined operations.

- Automate processes to reduce errors and save time.

- Allocate resources most effectively.

Accurate insights into financial health, across your organization.

- Data from multiple systems is conveniently visible.

- Facilitate informed strategic decisions.

- Identify growth opportunities.

- Mitigate risks effectively.

Improved financial performance.

- Optimize cash flow.

- Reduce costs.

Innovation.

- Time gained for strategic decision-making, development, creativity, and business growth focused on the most profitable outcomes.

Enhanced transparency and accountability.

- Foster trust among staff, stakeholders, and investors.

Meet required standards.

- Capitalization.

- Detailed time tracking.

Employee Advantages:

Individuals and teams are equipped with essential resources for optimal performance.

- Optimized processes and automated workflows increase productivity.

- Focus can be on value-adding activities that go beyond administrative tasks.

- An engaged workforce can lead to innovation.

Positive work culture.

- Reduced frustration associated with complex financial processes.

- Improved morale and job satisfaction.

Can The Hershey Company overcome a cancelled Halloween and disrupted supply chains, due to the pandemic shutdowns?

YES. Here’s how Rego helped them identify and overcome obstacles and deliver record value.

Can a nonprofit hospital system and research organization predict whether a reduced staff has the capacity to complete critically important revenue-generating projects?

YES. Here’s how Rego enabled them to track resources and improve their financial forecasting.

Can Chipotle advance rocketing growth, with 2,700 restaurants operating individually and no reliable data for the executives?

YES. Here’s how Rego assisted in scaling their transformation and improved their productivity.

How to Make Simplicity Your Reality

Introducing the Product Funding Model—Why What You Fund Can Generate Simplicity

The product funding model—also known as capacity-based funding model—is a proven method that offers a strategic framework designed to streamline financial operations, enhance transparency, and empower your organization to adapt swiftly to changing market dynamics.

It can help your organization decide where to invest your resources, by focusing on initiatives that bring the most value to your goals. Business sponsors or Product Managers evaluate initiatives based on its potential impact, allocate resources accordingly, monitor progress closely, and adjust as needed to maximize success.

Let’s look at how this can benefit your organization.

As the name implies, products are the funding focus, rather than projects. Note: “Products” can be any single initiative that is of value to the organization, whether consumer goods, services, infrastructure projects, campaigns, or more.

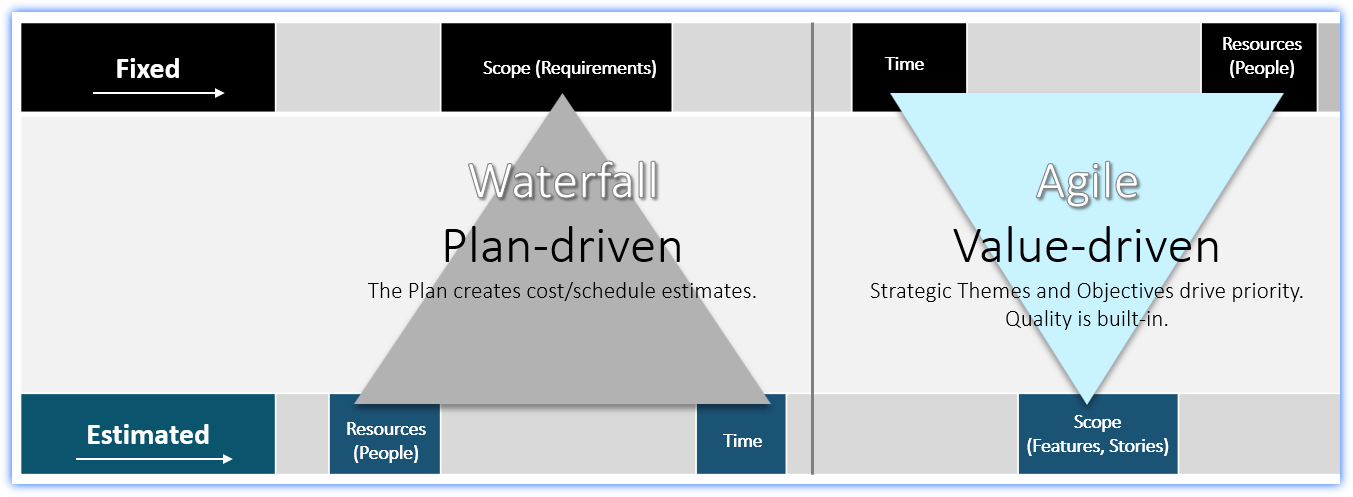

Project Funding Model

(Waterfall Plan-driven)

- Projects are timeboxed. There is an assumed start and stop date. This results in creating many Projects in both Clarity and Rally.

- Teams and resources are staffed on Projects often resulting in resources being spread across multiple Projects at the same time.

- Annual planning activities take months and forces teams to estimate time to market and costs based on very high-level requirements.

- Principals align to typical Waterfall processes.

Product Funding Model

(Agile Value-driven)

- Products are NOT timeboxed. Products live if they are profitable. Projects in both Clarity and Rally exist so long as a Product supports customers.

- Teams and resources are static and support a single Product or Product Group. Work is brought to these static teams simplifying budgeting and planning.

- Annual planning takes weeks because budgets and costs are established by static teams. Product Backlogs are prioritized and ranked. Teams move to high-margin Products.

- Principals align to typical Agile Scrum or Agile Kanban processes.

How the Product Funding Model Can Increase Simplicity and Help You Deliver Value

Resource Optimization.

- Traditional resource supply and demand balancing is no longer needed because a set of resources is fixed and fully dedicated to the initiative. Therefore, there is no longer the need for hours and hours of complex evaluation regarding what skills are needed and who might be available to support the effort.

- Improve efficiency and cost-effectiveness.

Strategic Alignment.

- Prioritize initiatives that contribute most significantly to business objectives.

- Strengthen overall strategic focus and alignment.

Transparency and Accountability.

- Ensure resource allocation decisions are transparent, fair, and based on objective criteria.

- Enhance governance and decision-making processes.

- Foster trust and confidence among stakeholders.

Risk Management.

- Mitigate investment risks through informed decisions, resource allocation, prioritization, and contingency planning.

Adaptability and Flexibility.

- Pivot quickly to changing market conditions and priorities.

- Focus on the most profitable projects.

- Attain maximum return on investment (ROI).

Note – Although the product funding model works especially well within an Agile methodology, a company does not have to be 100% Agile based to employ the product funding model.

For an informative and relatable story about the product funding model, review this free white paper: Accelerating Value with Capacity-Based Funding: A Tale of Two Finance Executives

Companion Considerations of the Product Funding Model

Team Centricity and Total Cost of Ownership (TCO) can enhance simplicity, and both pair beautifully with the product funding model. Let’s explore both concepts.

Team-Centricity Benefits

How can utilizing dedicated teams in your organization increase simplicity and productivity?

Aligned Objectives.

- Teams are poised to work toward common goals with purpose and clarity.

Cross-Functional Collaboration.

- Diverse teams can work collaboratively, leveraging collective expertise, sharing knowledge, and innovating effectively.

Ownership and Accountability.

- Teams drive initiatives and take responsibility for delivering results.

Flexibility and Adaptability.

- Nimble resource allocation allows teams to respond quickly to changing priorities and market conditions.

Continuous Improvement.

- Iterative value delivery enables teams to continuously evaluate and improve processes and practices.

- Teams can apply lessons learned, refine approaches, and drive ongoing innovation.

Total Cost of Ownership (TCO)

Why is it important to have an accurate understanding of all the spend across your organization?

TCO provides comprehensive visibility, enabling you to plan effectively with a clear understanding of the entire landscape, rather than relying on fragmented data slices.

This holistic approach empowers organizations to make informed decisions about resource allocation, budgeting, and investment prioritization. This optimizes investments, minimizes costs, and maximizes value across the entire lifecycle of product initiatives.

Tools and Ecosystem

To transition to a simpler, value-driven ecosystem, consider these additional tools. They can easily partner with the product funding model and can integrate seamlessly together.

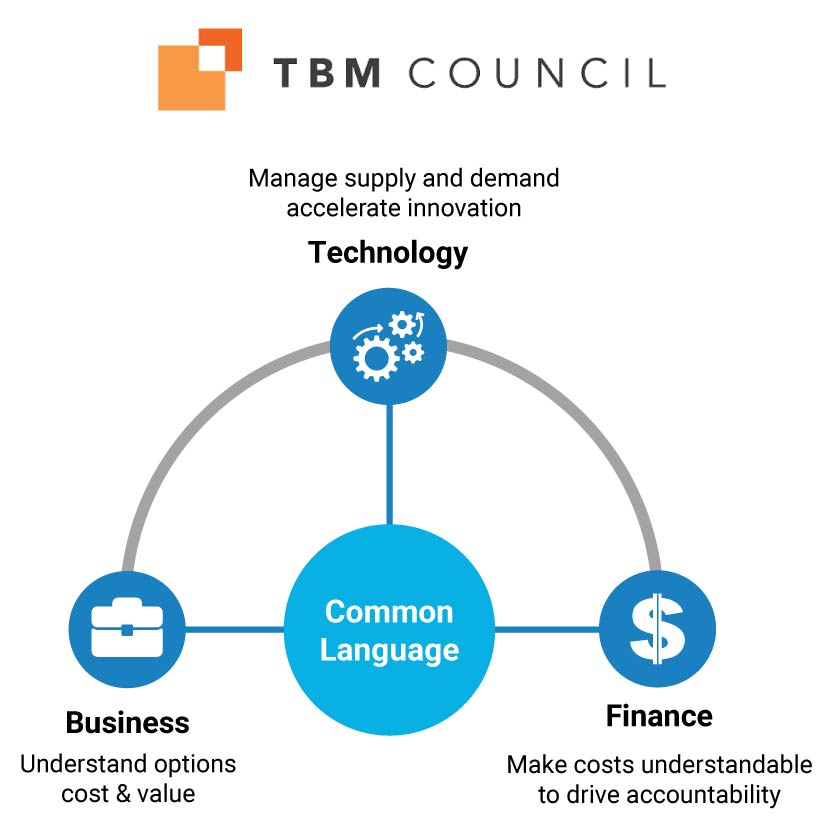

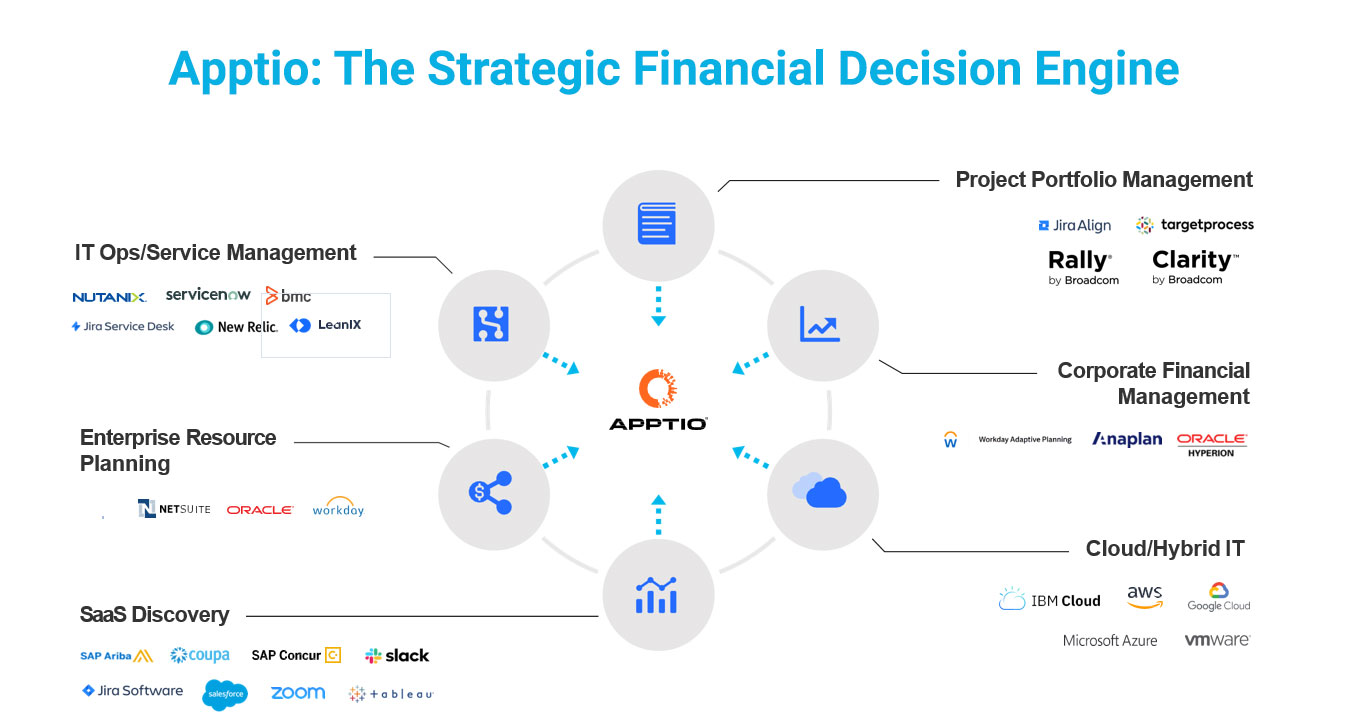

Technology Business Management (TBM)

The TBM framework is a method for companies to gain transparency into their IT spend. In real time, you can see what money is spent, for what purpose, and measure if it is producing value. When your organization has this level of transparency, you can determine ROI and the TCO. Informed decisions can then accelerate value.

Learn more in this free article: Introduction to Technology Business Management

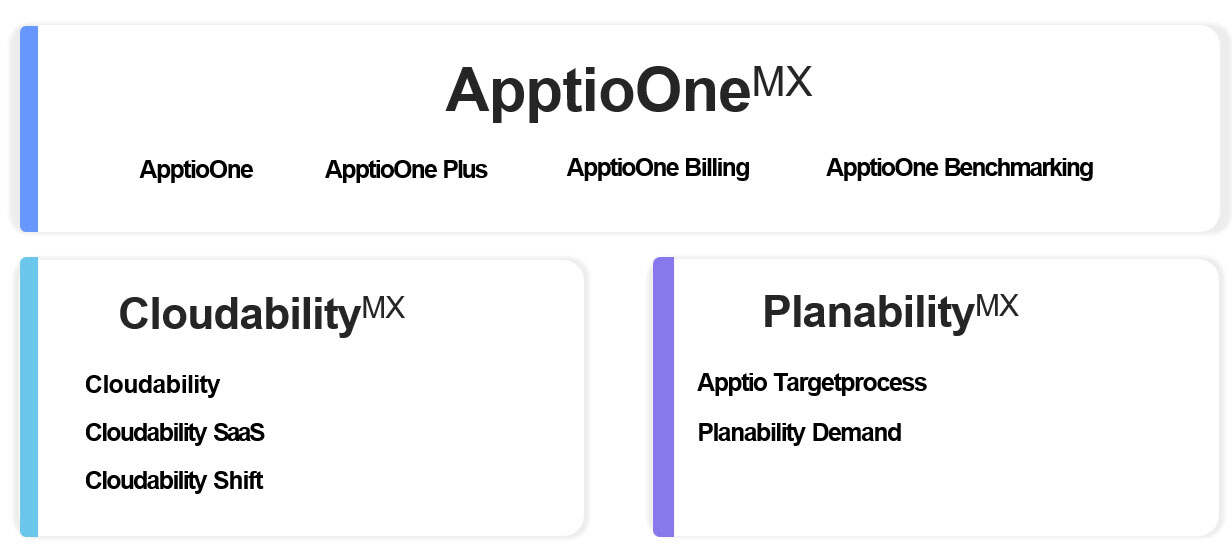

ApptioOne

ApptioOne (also referred to as Apptio) is a robust product platform that supports the Technology Business Framework (TBM).

It is an easy-to-use and centralized data hub that provides a very clear picture of your TCO. It is purpose-built to efficiently bring in data from all types of data sources—including project portfolio, finance data, cloud, SFTP servers, infrastructure data, application programming interfaces (APIs), configuration management databases (CMDBs), and even Excel spreadsheets. Within ApptioOne, users can normalize and modify the data. Additionally, they can automate processes, saving time and effort while ensuring data accuracy.

ApptioOne can produce meaningful reports through its robust reporting system. It also contains a BI engine for ad hoc reporting. Since all the data integrates, you can quickly observe the impacts of changes.

Additionally, ApptioOne can leverage scrubbed data from all their clients to provide comparative benchmarking, providing an opportunity for continuous optimization.

ApptioOne also offers purpose-designed tools, including Cloudability and Targetprocess.

Cloudability is an Apptio tool that brings together data from multi-cloud, hybrid, and SaaS platforms to deliver new financial insights. Utilizing financial management best practices, it provides suggestions on data usage and utilization, and how to optimize cloud funding.

Targetprocess (also called Apptio Targetprocess or ATP) is an Agile tool calculated to maximize investment planning. Targetprocess is specifically designed to support the shift from Waterfall to Agile methodologies. Within Targetprocess, you can strategically align goals to work by uniting development resources to business outcomes. You can plan and track value delivery for products or projects.

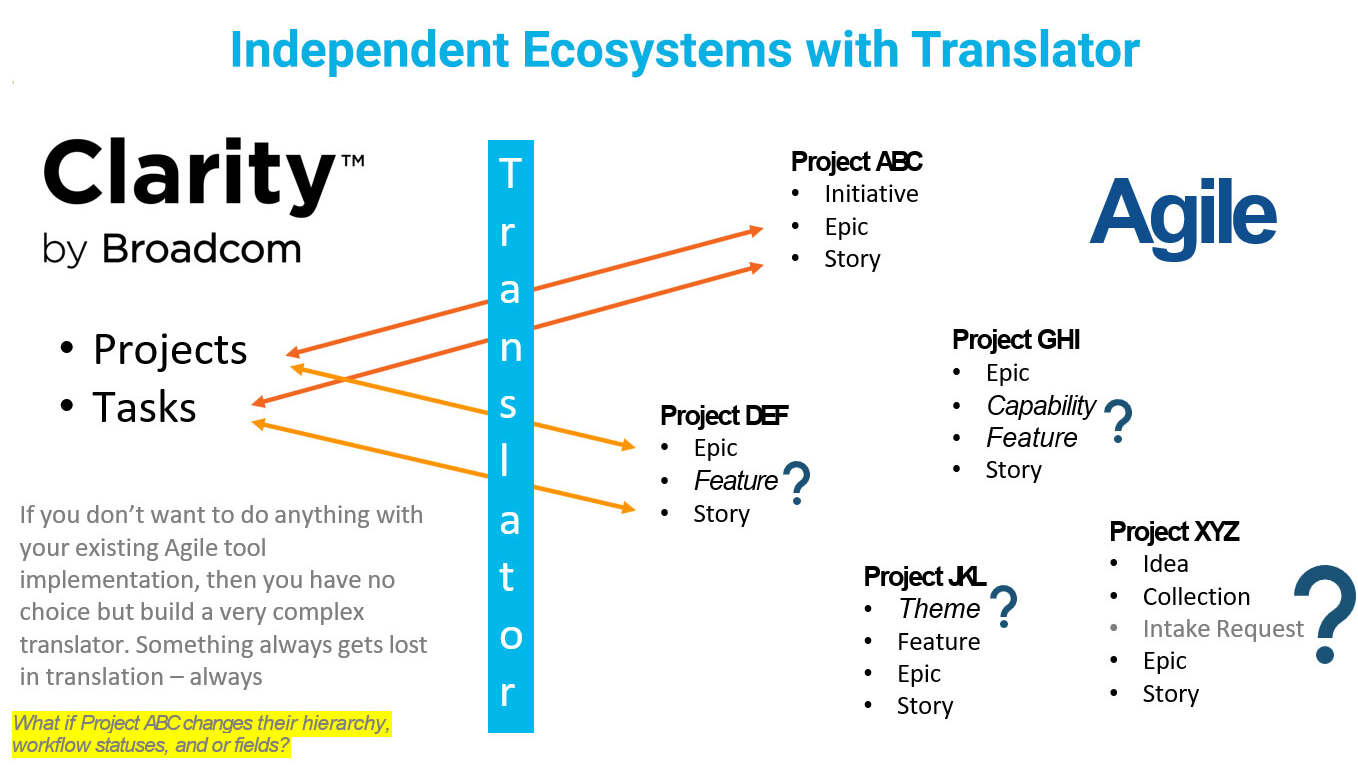

Clarity by Broadcom

Over the years, Clarity has adapted new capabilities to support Strategic Portfolio Management best practices, such as product funding models, strategic alignment, and value management—including OKR tracking.

“Translators” play an important role in integrating Clarity with Agile tools, such as Targetprocess or JIRA. Even if your organization’s financial system follows a more traditional Waterfall approach, translators can assist in bridging the gap to adopt more Agile ways of working.

Specifically, translators act as integration mechanisms between the different taxonomies and constructs used in Clarity (projects, tasks) versus Agile tools (epics, stories, and more).

These connections between Agile and financial tools can support organizations through the transition to more Agile ways of working, while still leveraging your existing instance of Clarity to meet your financial management needs.

Opportunities for Simplification

In addition to the product funding model and the robust tools described above, your organization may benefit from simplification in the following areas.

Capitalization of Expenses

Capital Expenditure can simplify financials by providing a more accurate representation of the long-term value generated by investments, improving asset management practices, enhancing financial ratios, and aligning financial reporting with business strategy.

It is important to note that capitalization has reporting and tax implications, so it is vital to provide your finance team with options for capitalization rather than prescribing one specific approach.

Here are some options for handling capitalization in an agile environment:

- If you are using Jira, consume work logs from Jira to pull time data into Clarity.

- Convert completed story points into time/costs based on team rates per story point.

- Derive time from the amount of time work is actively being worked on in Agile tools.

- Convert forecasts into actuals.

FASB 86 categories of expenses and potentially capitalized costs:

Expense

Costs associated with establishing feasibility of a program, including:

- Feasibility research and prototyping

- Analysis and formulation of alternatives

- High-level architectural work in support of decision-making

- Training

- Production maintenance and support

Capitalize

Costs associated with committed new projects and upgrades and enhancements that increase functionality of existing software which may include:

- Detailed design activities (maybe)

- Salaries

- Cost of materials Contract labor

- Burden

- Excludes specifically general and administrative costs and overhead.

Time Tracking

Here are some options for managing time tracking in an agile environment:

Instead of having developers go back to Clarity to fill out timesheets, consume the work logs from JIRA which show time spent on issues. This avoids duplicate data entry.

Handle non-project time like PTO and training as an edge case in Clarity since it is not ideal to track in JIRA.

Do away with timesheets altogether and instead consume completed story points. Map story points to rates per team to calculate labor capitalization.

Use “touchless timesheets” to derive time from timestamps and workflow of user stories in JIRA.

Convert forecasts into actuals to simplify time tracking.

Get Started – Shift to Simplicity Today!

Here are some practical suggestions to begin with a “crawl, walk, run” approach.

Understand and Unify

Understand your financial landscape.

To move forward, you must know where you start. Begin by evaluating the current status of your financial landscape. Identify bottlenecks and areas of duplicated efforts.

Move forward with C-Suite support.

Complex financial challenges require cross-capability collaboration, but success is within sight when executives share a vision. Departments to consider are:

- Strategic Portfoloio Management (SPM)/Project Portfoloio Management (PPM).

- Financial Management.

- Technology Business Management (TMB).

- Agile Services.

Start Small

Understandably, finance teams can be hesitant to move to a new funding model. Finance leaders may worry about losing visibility. And, as mentioned above, flipping the entire organization’s funding model overnight is a common mistake that often leads to failure and frustration.

Instead, we recommend starting in small increments with a pilot team. Then you can demonstrate the successful outputs of the team, the time saved, and the ability to pivot quickly. The finance team will see that finances are visible—in a way that is potentially even more meaningful.

For example—as discussed in the Rego webinar, “Removing Complexity from Funding and Financials,”—Rego worked with an organization in the healthcare industry that had a tight-knit network security team. Before shifting funding models, dealing with a new security threat meant diverting precious time to analyze the problem, forecast team members, create a new project, and finally begin work on the issue.

To test the product funding model, the network security team initially transitioned. It worked amazingly well! In this new structure, the team treated each threat as a product, prioritizing each based on urgency and addressing their backlog accordingly. This flexible approach resulted in a much more effective team—reducing the time it took to address new threats from months to weeks!

Customize to Your Business Needs

As you implement these strategies and your business processes become more streamlined, leadership can consider other areas in your organization that would benefit from the product funding model. It may make sense to implement a hybrid funding model approach to fit your unique business strategy.

Conclusion

By implementing innovative solutions such as the product funding model, Clarity, the Technology Business Management (TBM) framework, ApptioOne, Cloudability, and Targetprocess, organizations have been able to simplify their funding and financials. You can too!

Rego Can Help You Soar!

If you want help coming up with ideas to simplify your funding and financial processes, contact us for a no pressure conversation. Our funding and financial experts love bouncing around ideas and connecting with you.

Rego Webinar: Removing Complexity from Funding and Financials

Product Funding Model

Book: Project to Product by Mik Kersten

Technology Business Management (TBM):

TBM: How Rego can help

- Why it Matters

- What’s Holding You Back

- The Solution: a Streamlined, Transparent, and Flexible Financial System

- How to Make Simplicity Your Reality

- Companion Considerations of the Product Funding Model

- Tools and Ecosystem

- Get Started – Shift to Simplicity Today!

- Conclusion

- Rego Can Help You Soar!

- About the Author: Rego Consulting