What is FinOps?

FinOps is a framework for optimizing cloud costs through collaboration, transparency, and accountability. It’s not a tool, but a set of best practices that can be applied to any cloud environment.

FinOps practices equip finance, engineering, and operations to work together to gain maximum value from their cloud investments in a way that supports business objectives. It is built on principles that promote visibility, accountability, and continuous improvement, making it an essential practice for any organization that uses cloud services.

Key Concepts of FinOps

Rego’s award-winning experts have distilled the essentials of the FinOps framework into the following key concepts.

1. Visibility of Cloud Spending and Resource Utilization

The FinOps framework provides real-time visibility into cloud spending, even across multi-cloud environments.

- This transparency is essential for teams to understand their current cloud investments, make faster and better financial decisions, and optimize cloud costs.

- Real-time visibility into spending patterns and resource utilization helps businesses detect inefficiencies and anomalies in spending, and take corrective action before costs spiral out of control.

2. Collaboration Between Finance, Engineering, and Operations

FinOps fosters collaboration across these key departments to ensure cloud spending aligns with business goals. By bringing together cross-functional teams, FinOps helps bridge the gap between financial objectives and technical realities.

- Finance teams bring financial discipline, ensuring that budgets are adhered to, and that cloud spending delivers value.

- Engineering teams provide technical expertise, ensuring that cloud resources are used efficiently and effectively.

- Operations teams ensure that the infrastructure is running smoothly and that any issues are addressed promptly.

By working together, these teams can create a holistic approach to cloud management that balances cost, performance, and business needs.

3. Accountability for Cloud Costs and Usage

FinOps establishes accountability for cloud spend by identifying usage and associating expenses to specific teams or departments, and linking costs directly to business outcomes. By establishing clear ownership of cloud resources, teams are held responsible for their spending and are encouraged to carefully manage their cloud use.

- Organizations can use dashboards and reporting tools to separate cloud costs by department, project, or application, ensuring everyone understands their contribution to the overall cloud cost.

- With detailed visibility, teams can track usage trends, forecast future costs, and align spending with business goals.

- This accountability fosters a culture of continuous improvement and proactive management.

Unknown artist. (April 2021.) [Image of cartoon “Are you sure this is how we get data into the cloud.”] Retrieved November 17, 2024 from www.medium.com.

All joking aside, inscrutable cloud spending, poor collaboration, and a lack of accountability can cause serious problems.

Why is FinOps Necessary?

Managing cloud costs and optimizing cloud resources is increasingly complex, especially as organizations adopt various cloud technologies. The shift to cloud-based infrastructures introduces new challenges, such as fluctuating costs, complex pricing models, and multi-cloud environments.

What is the Cost of Ignoring FinOps Best Practices?

Without a way to accurately evaluate cloud costs, organizations cannot make data-backed decisions. This can result in excessive and unnecessary spending, inaccurate budgets, and wasted resources.

Without a clear strategy for managing cloud costs, organizations risk facing unexpected costs, resource waste, and complex multi-cloud environments. These challenges make it extremely difficult to align cloud spending with business objectives.

Let’s explore the root causes of each of these issues.

FinOps Solutions for Saving Money

FinOps solutions provide many cost-saving benefits.

Organization-Wide Benefits of FinOps

In addition to the cost-saving solutions above, there are organization-wide benefits to adopting the FinOps framework.

Data-Driven Forecasting and Decision Making. Continuous monitoring and predictive analytics equip organizations to identify trends, model “what if” scenarios, and evaluate the impact of decisions before implementation. Analytics and real-time data empower teams to make smarter, faster decisions that align with business objectives.

Faster Time-to-Value and Cost Control. FinOps improves ROI by streamlining processes and optimizing cloud spending. It ensures cost control by leveraging real-time data to prioritize high-value initiatives, reduce waste, and efficiently allocate resources.

Cross-Department Collaboration. FinOps fosters collaboration among finance, engineering, and operations. Shared dashboards, regular cost allocation reviews, and collaborative planning sessions help align priorities and enable better communication between teams. FinOps encourages open dialogue and consistent engagement, breaking down silos and fostering teamwork.

Improved Accountability. FinOps ensures that teams and departments take ownership of their cloud spending and usage. By providing clear reporting dashboards that reveal spending and resource allocation, FinOps establishes accountability at every level. Supported by automated tools, reports, and regular cost reviews to reinforce responsibility, teams are empowered to monitor and manage their own costs. This fosters better decision making and cost management.

Improved Budget Management. FinOps ensures budgets are accurate, realistic, and aligned with organizational priorities, enabling proactive financial planning and resource allocation. With forecasting tools and real-time analytics, FinOps equips teams to set budgets tied to usage patterns, track spending against allocations, and adjust forecasts based on actual resource utilization.

Advanced Resource Allocation FinOps practices align resource allocation with organizational goals, ensuring their work will deliver the greatest possible impact. To do this, FinOps identifies underutilized resources, promotes decommissioning idle instances, and recommends energy-efficient services, ensuring optimal use of both physical and virtual assets.

Waste Reduction. FinOps eliminates unnecessary wasted resources and data by analyzing resource utilization to pinpoint idle virtual machines, redundant data, and overprovisioned systems. FinOps establishes cleanup processes and promotes accountability to ensure efficient usage. This reduces costs and improves operational efficiency.

Vendor Negotiation Leverage. FinOps provides the necessary data visibility to negotiate better terms and discounts with cloud vendors, optimizing contracts for cost savings. By consolidating and analyzing cloud spend across providers, FinOps gives organizations the insights they need to negotiate pricing, secure volume discounts, and optimize contract terms based on actual usage patterns.

Environmental Sustainability. FinOps encourages the use of energy-efficient services and strategies to minimize the carbon footprint of cloud operations. By promoting energy-efficient cloud services, identifying opportunities to reduce electronic waste, and aligning with green initiatives offered by cloud providers, FinOps helps organizations achieve sustainability goals while saving money.

Improved Governance and Compliance. FinOps creates a standardized framework for managing cloud costs and ensuring compliance with organizational policies. It enforces consistent tagging, billing, and reporting standards, ensuring spending adheres to governance policies. Compliance monitoring tools prevent policy violations and reduce financial risks.

Scalability and Adaptability. As organizations grow, their cloud needs evolve. FinOps provides a scalable approach that can adapt to changing business requirements. Governance processes, like automated provisioning and dynamic cost allocation, help organizations manage growing cloud footprints while maintaining financial control and efficiency.

As these benefits demonstrate, when you adopt the FinOps framework, your organization is equipped with data visibility, cross-department collaboration, and accountability. This empowers you to make smarter decisions faster, minimize waste, and optimize spending.

Let’s get started!

How to Get Started with FinOps

Fletcher, D. (n.d.). [Cartoon of a cloud asking another cloud what it wants to be when it grows up]. CloudTweaks. Retrieved November 16, 2024, from www.pinterest.com

Start with a FinOps Team

The first step in adopting FinOps practices is to create a cross-functional FinOps team. To establish collaboration across all areas of cloud management, this team should include people from finance, engineering, and operations.

The goal of the FinOps Team is to promote FinOps best practices across the organization and ensure that all cloud costs align with the organization’s objectives. To do this, they will utilize data visibility to develop a shared understanding of cloud costs and drive accountability for cloud spending.

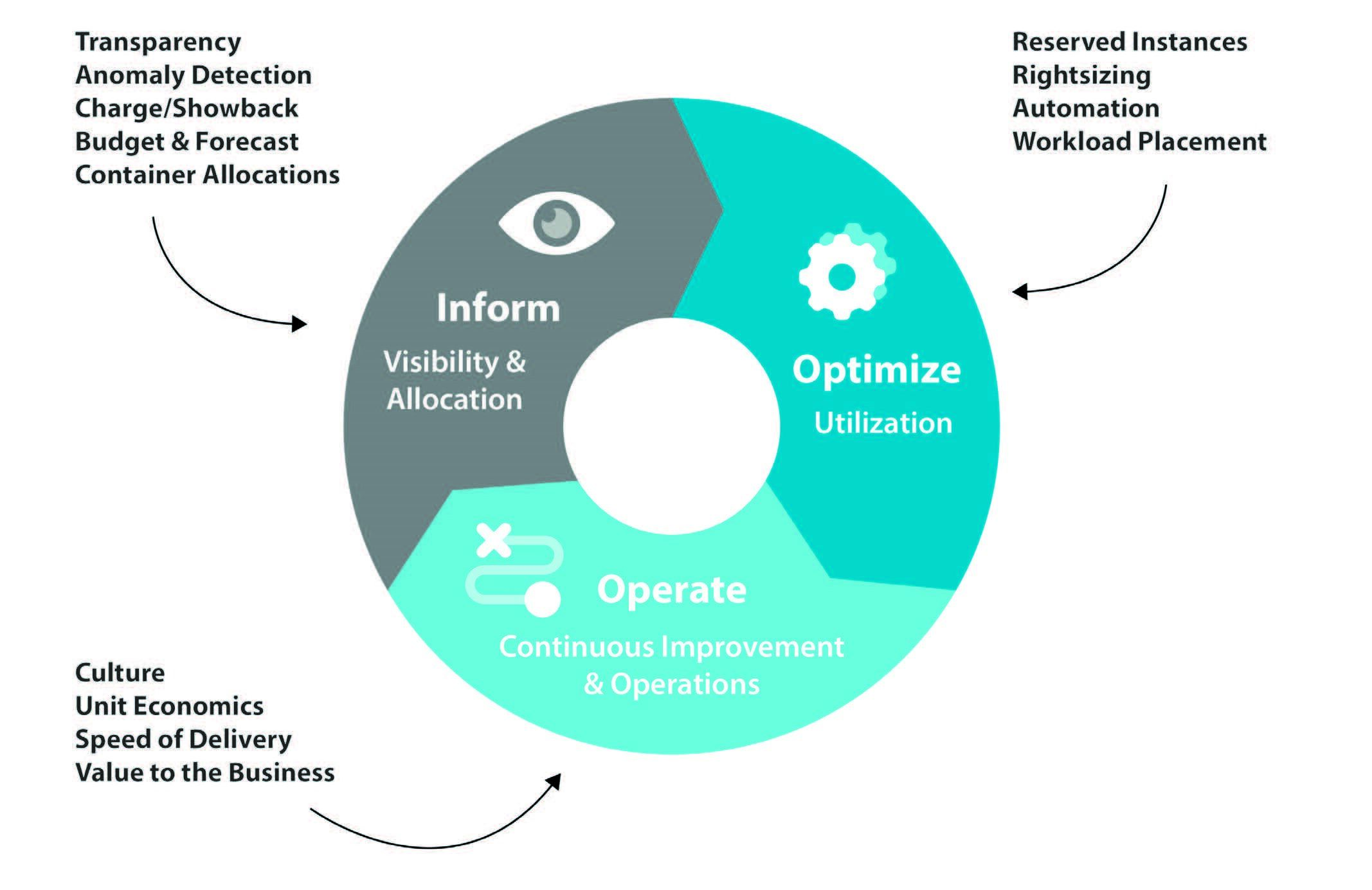

FinOps is a Continuous Cycle of Improvement

FinOps is not a one-time effort, but an ongoing journey towards cloud cost efficiency, collaboration, and better data-backed decision making. As an organization matures in its FinOps best practices, it will be able to achieve greater financial control, optimize cloud usage, and drive better business outcomes.

The FinOps life cycle follows three main phases:

- 1

Inform: Visibility and Allocation.

- 2

Optimize: Utilization.

- 3

Operate: Continuous Improvement and Operations.

Note that an organization may be in multiple phases, due to individual business units or teams’ progression.

Image credit: The FinOps Foundation

Rego experts find that intentional focus on collaboration throughout the entire process will enhance success. By breaking down silos and fostering a culture of teamwork, cross-departmental teams can optimize cloud spending and maximize business value, ensuring that every dollar spent on the cloud delivers strategic impact.

In addition to collaboration, ongoing skill development and capacity building are crucial components of FinOps success. These investments ensure that everyone is equipped to efficiently contribute to the organization’s objectives.

The Best Tools for FinOps

Having the right tool for the job is the first step to success. Although FinOps can be applied using a variety of tools, there are specific tools designed to efficiently provide FinOps solutions.

What Can the Best FinOps Tools do?

The best FinOps tools include these features:

These features empower your teams with the visibility, control, and insights they need to enhance efficiency and reduce unnecessary cloud spend.

Best FinOps Tools on the Market Today

Gartner and Forrester are two objective research companies that provide insights and guidance to help organizations make better decisions and improve performance. Their research of Cloud FinOps tools is presented here for your consideration.

The Gartner Magic Quadrant for Cloud Financial Management Tools is a comprehensive report that evaluates and ranks vendors based on their completeness of vision and ability to execute. In 2024, IBM’s Apptio was rated as the strongest “Leader” by a long shot, attaining the best score for “Ability to Execute,” and “Completeness of Vision.”

In The Forrester Wave Cloud Cost Management and Optimization Solutions (Q3 2024), IBM Apptio received the highest score possible in “Stronger Strategy” and “Stronger current offering.”

Interested in the learning about IBM Apptio? Learn more here.

Key Takeaways

FinOps is a set of practices that provides visibility into cloud spending, empowering cost optimization.

FinOps promotes collaboration between finance, engineering, and operations.

FinOps promotes increased accountability for cloud cost and usage.

FinOps empowers teams to make better data-driven decisions that optimize cloud resource usage and align decisions with the organization’s overall business objectives.

FinOps is a continuous cycle of improvement.

Resources

Learn about FinOps:

-

- The FinOps Foundation https://www.finops.org/

- Free resources from expert FinOps guides:

-

- Watch Rego’s free on-demand webinar, “What is Cloud FinOps?”

- Gain insights from Rego’s free white papers and articles to gain insights.

-

Get help with FinOps:

- Learn what Rego can offer you! https://regoconsulting.com/finops/

- FinOps Capability Assessment

- FinOps Best Practices Implementation

- Cost Management and Optimization

- Cloud Financial Operations Automation

- FinOps Managed Support

- Training

- And more!