In part one of our series on switching from project to Product Funding, we introduced some of the key difference between the two models. We also looked at some of the advantages of using a Product Funding. In this article, we will explore how to use Clarity (Clarity PPM) and Rally Software to start implementing a Product Funding model, specifically how to track financials with the two solutions.

Product Funding Structure

While Rally Software is not typically a tool used for financials, it can be used for parts of your Product Funding financials. And, when it is connected to Clarity (Clarity PPM), together, they create an effective solution for tracking Product Funding financials.

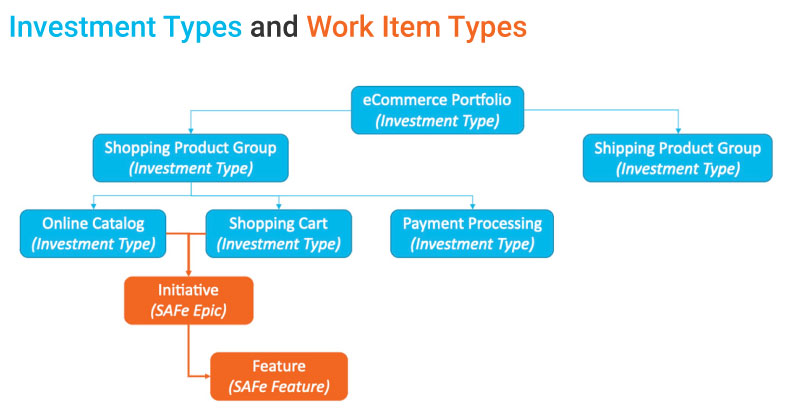

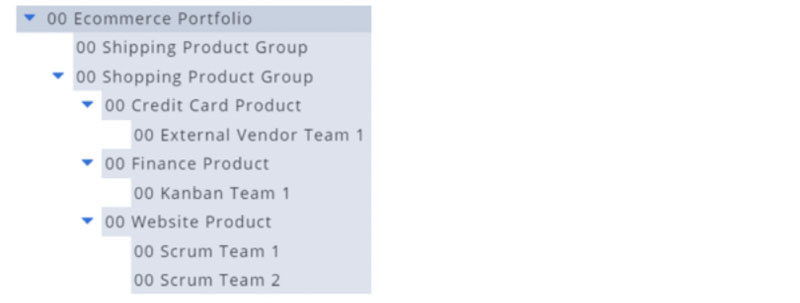

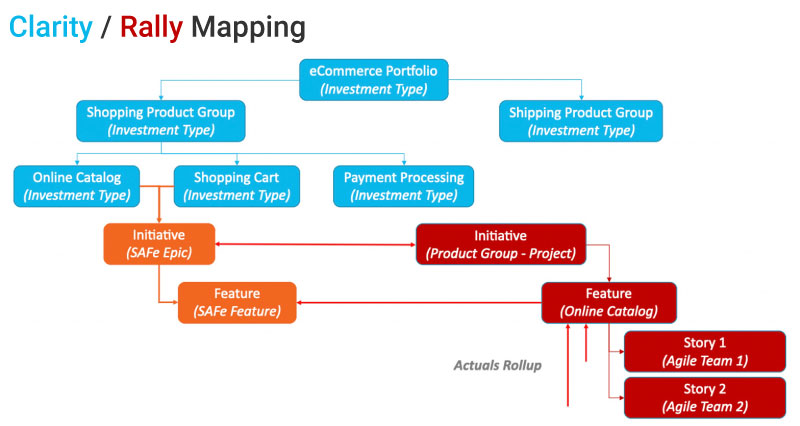

Figure 1.0

Before diving into how these connect with Clarity and Rally, it’s important to understand the structure of Product Funding.

Product Hierarchies

In the example above, you can see that this ecommerce portfolio Product hierarchy has three levels. They are marked as the as the blue boxes or investment types in Figure 1.0. You can have more or less, but this is just a standard example. As you can see, your investment types are part of the Product hierarchy.

Product

A Product is something that has cost associated with it as well as revenue. It has a revenue versus cost ratio. In our ecommerce example (Figure 1.0), the online catalog, shopping cart, and payment processing are all different Products. A collection of products belongs to a Product Group. In our example, they belong to the shopping Product Group.

Product Groups

Product Groups are exactly what they sound like, they are a group of Products. In our ecommerce example, you can see we have a shopping Product Group and shipping Product Group. If you drill down further, you can see that the online catalog, shopping cart, and payment processing are all products that belong to the shopping Product Group.

Operational Value Stream

An Operational Value Stream is a collection of products within a portfolio. In our example, it is the entire ecommerce portfolio.

Investment Type

Investment types are long lived entities (not time-boxed). They exist as long as Products are profitable. This could even be decades long.

Work Items

The orange items in our example (Figure 1.0) are work items. If your organization uses a Scaled Agile Framework (SAFe) the highest level would be your Epics, below that would be your features. Work items can roll-up to multiple products.

It is important to note that all work items are time-boxed. They can be as short as a day, or last as long as years. But no matter what, they always deliver additional value to a Product or Operational Value Stream. With Rally Software, work items are reflected in portfolio items.

Bringing it into Clarity and Rally

So now that you understand Product Funding structure, it’s time to tie it to Rally Software and Clarity (Clarity PPM).

Using Rally Software, you can make your Product hierarchies reflected in the project selector. We know it is kind of a misnomer to use a “project” selector for “Product” hierarchies, but don’t be thrown off by the name. The example below shows our ecommerce example in Rally.

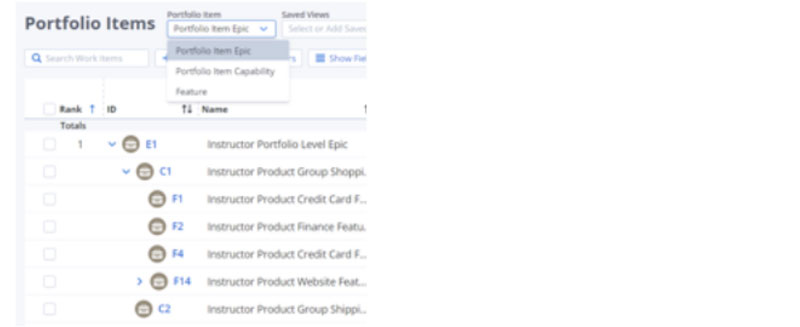

Figure 2.0

All of your blue items (your investment types) from figure 1.0 should be included using the project selector. Rally does a great job of rolling up Products and Product Groups, into the portfolio.

You will also see in figure 2.0 that Agile teams are the bottom of the roll up and are assigned to Products. You can have more than one teams assigned to a Product, but they should be the lowest “node” in the your project selector view. In our example above, you can see them labelled as “External Vendor Team 1, Kanban Team 1, Scrum Team 1, and Scrum team 2.”

If you adopt a Product Funding model, you will want to be sure your teams are aligned with a specific Product.

Work Items in Rally

Now you’re probably wondering what happened to those orange items from our ecommerce example from Figure 1.0. Those work items are time-boxed and should be reflected in your portfolio which they probably are already. Two good examples of these would be an initiative or a feature. If you are doing a Scaled Agile Framework, you could also include capabilities as work items.

Figure 3.0

Product Funding Financials

As mentioned in part 1 of this article series, Product Funding allows for a more Agile approach to financials. If a team needs to pivot during the year, the Product Owner can adjust already approved funds without having to go through a lengthy approval process. Product funding financials would primarily be tracked in Clarity, with data being pulled in from Rally. Let’s look at the financial tracking and then see how to tie everything together.

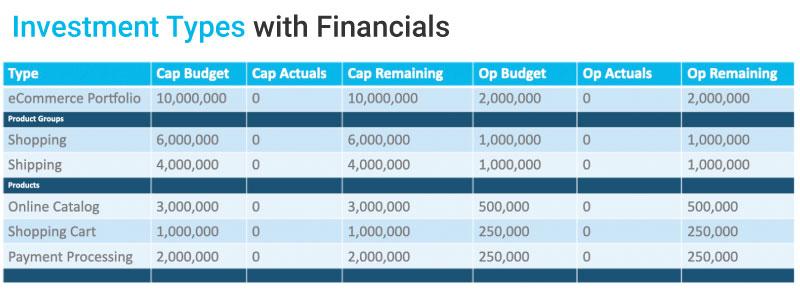

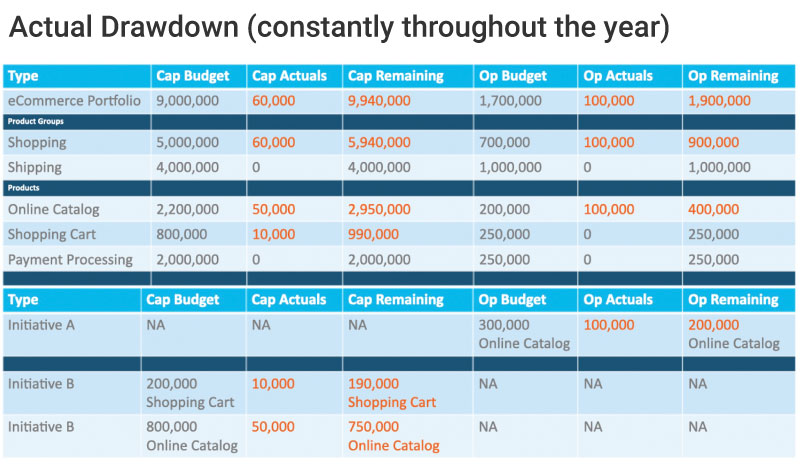

Figure 4.0

By sticking with the ecommerce portfolio example (figure 4.0), you can see that the annual budget approved for this portfolio is ten million dollars. That is broken down to six million dollars for our shopping Product Group and four million for our shipping Product Groups. If we drill down further, we can see the six million for the shopping Product Group is broken down further for the Products of the online catalog, shopping cart, and payment processing.

If needs change throughout the year, the Product Owner can redistribute funds between the Products. For example, the Product Owner could take one million dollars from payment processing and move it to the shopping cart if they needed to. Also, if the shipping Product Group needs two million dollars, the Product Owner can take it from the shopping Product Group and move it over.

The only time the Product Owner would need to get with Finance for approval is if they needed to go over the original ecommerce portfolio budget of ten million dollars. This is rare and usually only happens if something new comes up outside of the cost of people, because the portfolio already has dedicated resources. An example could be wanting to migrate to the cloud.

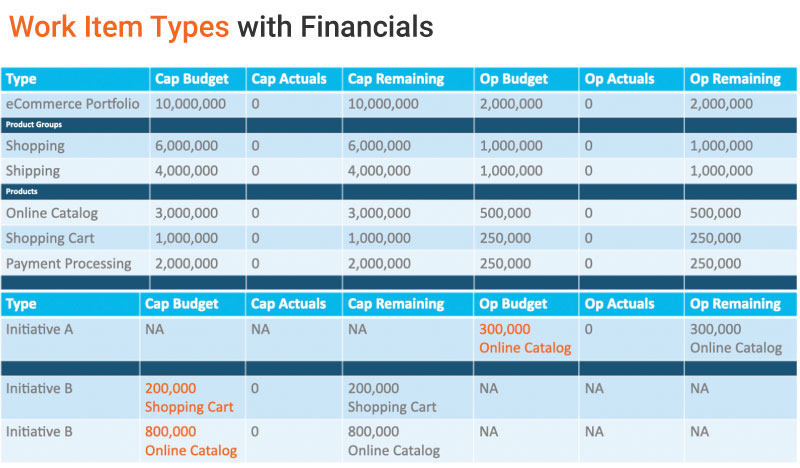

Figure 5.0

And if we drill down further to the initiatives (work items), you can see that funding can be drawn from multiple Products to complete time-boxed initiatives. In the case of Initiative B, 200,000 is taken from the shopping cart and 800,000 is drawn from the online catalog.

Tying it to Clarity

Over time, you will begin creating work items in Rally. If you look at the figure below, you will see in red, that we have an initiative, a feature, and even some child stories. You will probably even start creating subtasks under your child stories.

Figure 6.0

To bring this Rally data into Clarity where you manage financials, you can take the time and the actuals from your child stories (or their tasks) and roll them up to the feature level. You’ll want to use the feature level because it is usually the go-live unit of work. When the work goes live, you can begin your capitalization process.

Then, you can take that data and feed it into Clarity to compare the ongoing with your actuals for your initiatives or features, as shown below.

Figure 7.0

These initiative actuals roll up to their Products and Products Groups. By doing this you can watch the capitalization remaining (Cap Remaining) for the rest of the year. It’s a really great way to track your Product Funding financials with Clarity and Rally.

Rego Can Help

If you have questions about switching to Product Funding or have been exploring using it in your organization, Rego can help. Our team of expert Agile guides have helped countless companies through their project to Product Funding transformations. They know how to overcome common challenges like organizational resistance and cultural change, while implementing best practices and equipping you with support that will prepare you to adapt quickly. To learn more, watch our free on-demand webinar on Product Funding with Clarity and Rally Software, or contact us.

Rego also offers free configuration and adoption assessments, webinars, and half-day training classes for Clarity and Rally Software® on Roadmaps, Portfolio Management, Power BI, Scaled Agile, Jaspersoft.

For a full list of Clarity PPM services, visit regoconsulting.com.