What is Strategic Portfolio Management (SPM)?

Gartner defines Strategic Portfolio Management (SPM) as, “a set of business capabilities, processes, and supporting portfolio management technology.”1 The primary focus of SPM is to align each portfolio with the organization’s strategic objectives, ensuring that resources are allocated to initiatives that best support its overall mission and goals. It is also referred to as, “value-driven decision-making.”

Key Benefits of Strategic Portfolio Management (SPM)

The advantages of Strategic Portfolio Management (SPM) can be summarized as:

Strategic Portfolio Management (SPM) Supports Value

SPM benefits organizations by ensuring that all work is measured against other investments and organizational strategies. This strategic focus on value helps organizations make the most of their resources to benefit customers and stakeholders.

Strategic Portfolio Management (SPM) Empowers Agility

SPM enhances organizational agility by enabling quick resource pivots to new opportunities as market needs change. By aligning projects with strategic goals, SPM ensures swift responses to market shifts, efficient resource allocation, and sustained competitiveness. This flexibility allows companies to adapt and thrive in a dynamic business environment.

Misallocated Funds Due to Missing Strategic Portfolio Management (SPM)

In this real-life example, let’s see how Strategic Portfolio Management (SPM) works as an essential framework that helps executives link work to value and strategy, and the misguided decisions that can happen without SPM.

Imagine you live in a mid-sized city of 65,000 people. Your city council recently approved spending $62,000,000 to build two hockey arenas. The proposal’s business case demonstrated that the planned hockey tournaments per year would financially benefit local hotels, restaurants, and gas stations. Independently, the math looked good.

However – consider the bigger picture:

- Only about 2% of the city’s population is involved in hockey.

- The local businesses that will benefit account for about 0.05% of the city’s total businesses.

- $62,000,000 is equivalent to approximately 15 years of the city’s total recreational budget.

- These funds are provided through public taxation.

The approval of this project failed to apply the Strategic Portfolio Management (SPM) framework and consider the overall investments, assets, and needs of the community. Crucial big-picture questions were not addressed:

As a result:

- 98% of the population is paying for a facility they will never use.

- The majority of the city’s businesses will not benefit financially.

- Allocating the budget in this way does not leave funding for other recreational interests, such as racquet sports, indoor soccer facilities, splash pads, or pickleball (the fastest growing sport in the world)!

What if the city had taken a Strategic Portfolio Management approach?

What if the city had taken a Strategic Portfolio Management approach?

The city council would evaluate the merits of the proposed project against essential SPM considerations.

![]() City council members would ask: Will this project align with our city’s value of benefiting all citizens?

City council members would ask: Will this project align with our city’s value of benefiting all citizens?

- Answer: No.

- Although the project may fit a portion of the city’s recreation goals, it would be apparent that only a tiny portion of the population would benefit, and therefore not a good fit for the universal value of the city.

![]() The city council members would ask: Can this product pivot to support other valued initiatives?

The city council members would ask: Can this product pivot to support other valued initiatives?

- Answer: No.

- Locking funds into a 15-year project for single sport facilities does not allow adaptability of the city funds or resources.

Portfolio Assessment

- Apply strategic methods to evaluate the current portfolio.

- Identify strategic fit and value contribution of existing projects/products.

Resource Management

- Effectively allocate and utilize resources.

- Balance resource supply with strategic demand.

Risk Management

- Identify, assess, and mitigate risks at the portfolio level.

- Deploy techniques to manage uncertainty and volatility.

Strategic Roadmapping

- Develop and maintain a strategic roadmap.

- Align project/products and programs with long-term business objectives.

Strategic Portfolio Management (SPM) Critical Questions:

SPM guides all members of an organization to ask essential holistic questions. The answers to these questions guide executive leaders to prioritize the right initiatives at the right time.

How is Strategic Portfolio Management (SPM) different than Project Portfolio Management (PPM)?

Strategic Portfolio Management (SPM) expands beyond traditional Project Portfolio Management (PPM) by managing all types of work (projects, products, services, etc.) and ensuring the work continually links back to organizational value and strategy.

In the hockey facilities example above, the approved proposal for the hockey arenas may have been considered a Project Portfolio Management success, as the sole focus was on one project. However, Strategic Portfolio Management includes a more comprehensive scope. Strategic Portfolio Management is the evolutionary progression of Project Portfolio Management.

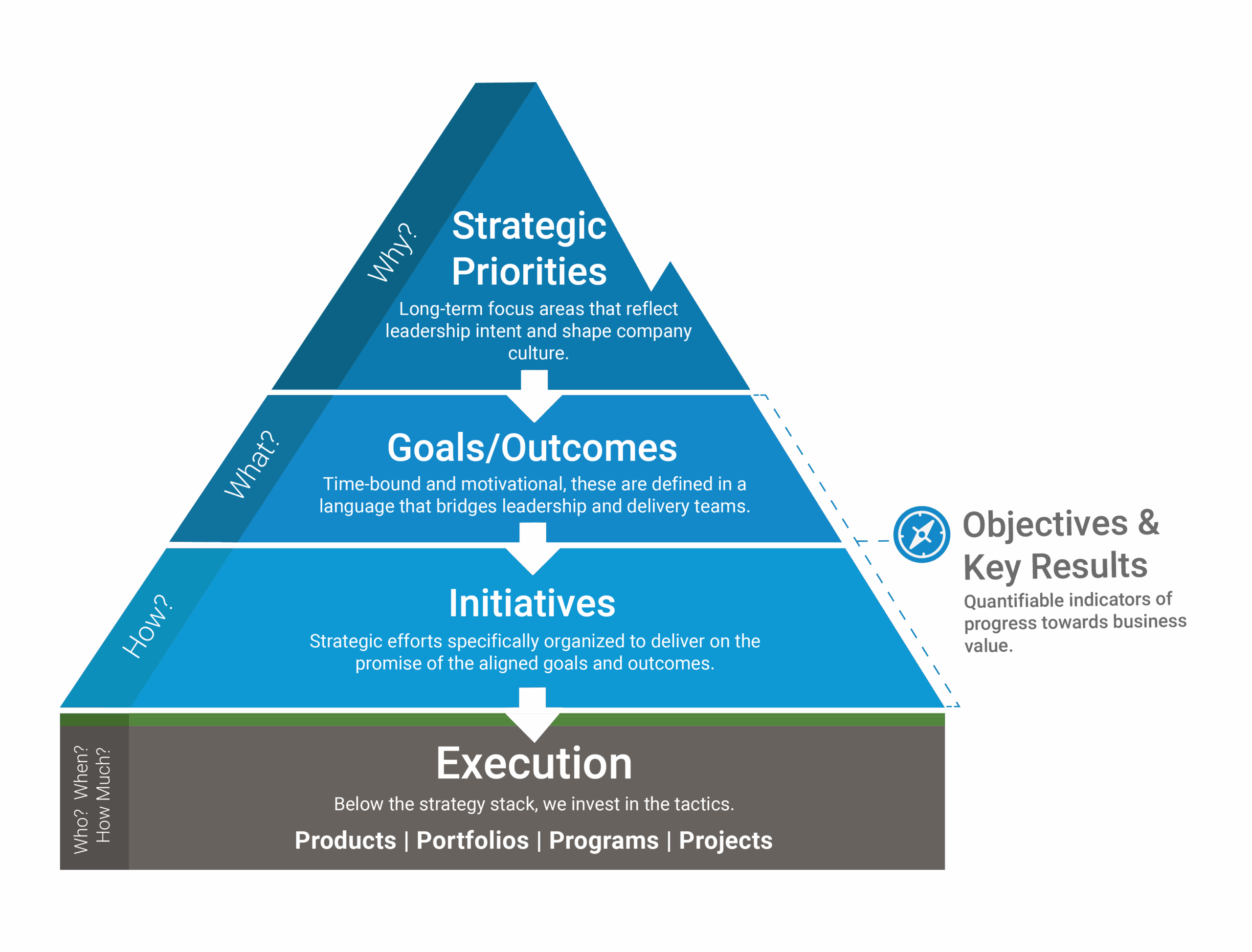

To illustrate this, the following graphic depicts the Strategic Portfolio Management hierarchy. Only the bottom two tiers of the pyramid are included in Project Portfolio Management.

Strategic Planning Frameworks

The new taxonomies in this graphic were introduced at the Gartner IT Symposium 2023, and PMI Global Summit 2023. A standardization of an industry-accepted taxonomy for strategic planning is in the works. Currently, there is still some variability at the top of the pyramid, regarding the taxonomy of value, vision, and mission. The remaining classifications are predominately standard.

From the top to the base of the pyramid, there are three strategic levels of progressive adaptation/change management: Direction, Alignment, and Execution.

1. Strategic Direction. Governance is lead by the Executive Team.

- Values

- Mission

- Vision

- Strategic Imperatives

- Strategic Goals

2. Strategic Alignment. Rego experts have observed a trend in the governance of this framework. Governance is shifting from the Project Management Office (PMO) to the Strategic Realization Office (SRO).

- Strategic Initiatives (Programs and Projects)

- Portfolio Management (This can also fit under Strategic Execution)

3. Strategic Execution. Rego experts have observed a trend in the governance of this framework. Governance is shifting from the Project Management Office (PMO) to the Strategic Realization Office (SRO).

- Portfolio Management (This can also fit under Strategic Alignment)

- Project Execution

As value-driven decision-making and SPM adoption increase, Rego anticipates the injection of this value alignment and measurement at the execution level. This trend is already driving a shift in how this space is referred to in general: as Strategic Portfolio Management (SPM), not Project Portfolio Management (PPM).

Differences between a Strategic Realization Office (SRO) and a Project Management Office (PMO)

There is often confusion between Strategic Realization Office (SRO) and Project Management Office (PMO) roles and responsibilities. They both add value to strategic management, but there are important differences.

The Strategic Realization Office

- The Strategic Realization Office (SRO) emphasizes implementing the right projects and evaluating whether they serve the organization’s strategic alignment needs.

Executive leadership implements the SRO to better understand the enterprise strategy.

The Project Management Office

- The Project Management Office (PMO) focuses on implementing projects properly and efficiently, supporting project managers in sharing resources, as well as best practices, coaching, and monitoring compliance with project and process standards.

The PMO is responsible for executing the strategies that are assigned by the SRO.

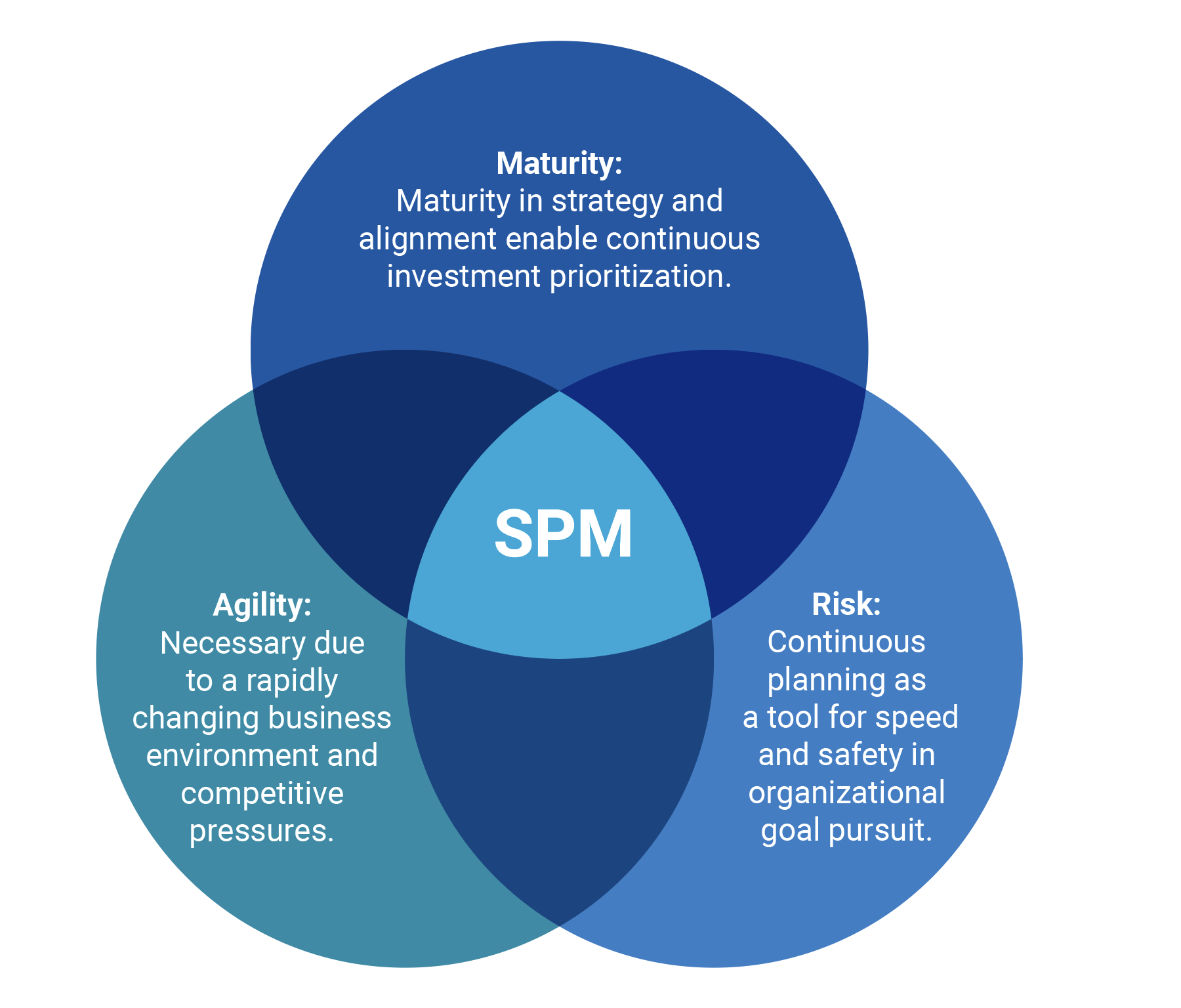

Why Does Strategic Portfolio Management (SPM) Matter Now?

The increased utilization of Strategic Portfolio Management (SPM) has been gaining momentum over the past few years. What is prompting SPM to be a priority?

SPM is essential for competing in the current marketplace for three reasons:

Maturity. Agility. Risk.

Maturity

The movement towards value-driven decision-making and Strategic Portfolio Management (SPM) is fueled by increasing organizational maturity. As organizations advance, they improve by aligning their work with strategic goals and translating company visions into measurable business objectives. This is often accomplished by utilizing OKRs (Objectives and Key Results).

The Strategic Portfolio Management framework empowers organizations to make decisions closely aligned with their overarching strategy. This heightened maturity in strategic planning practices ensures that strategy permeates every level of execution and decision-making. This ultimately drives the organization towards its long-term goals with greater precision and effectiveness.

Agility

Business agility has long been a key factor in successful organizations, but in today’s rapidly evolving business environment, it is more important than ever. Companies must pivot and leverage resources swiftly to respond to industry shifts and unforeseen challenges. For example, the COVID-19 pandemic underscored the critical need for organizations to react quickly and adapt their strategies to overcome challenges.

SPM is versatile and not bound to any single method of working, such as agile or waterfall. This flexibility enables organizations to manage their continuous planning using various approaches, adapting as needed to maintain strategic alignment and operational efficiency.

Risk

Risk is emerging as a significant driver for adoption of Strategic Portfolio Management and value-driven decision-making. Organizations are increasingly accepting risk, recognizing the necessity to pivot quickly and deliver results rapidly. By embedding strategy all the way down to the execution level, companies can embrace more risk while maintaining “guardrails” to ensure work remains aligned with strategic priorities. This flexibility allows for greater risk-taking since projects can be adjusted or redirected swiftly if their strategic value changes.

Additionally, Strategic Portfolio Management can mitigate risk for organizations, by enabling the evaluation of a wide range of investments—not just projects. This includes business capabilities, programs, digital and physical products, applications, and more. Each can be assessed against the organization’s values, ensuring comprehensive alignment with strategic goals.

How to Get Started with Strategic Portfolio Management (SPM)

Before implementing Strategic Portfolio Management, follow these guidelines.

Get Executive Buy-in

Assess the perspectives of executives regarding Objectives and Key Results (OKRs). Focus on strengthening organizational alignment and obtaining executive-level endorsement for value-based decision-making.

Understand Strategy and Value

Ensure there is a clear definition of top-level strategy and value within your organization. Engage with leadership to gain a comprehensive understanding, enabling you to effectively apply these values in work execution.

Plan for the Future

Consider evolving your Portfolio Management Office (PMO) by establishing an Strategy Realization Office (SRO) as part of your executive leadership team to achieve better strategic alignment and to guide the PMO with prioritization.

Evolution of Value-Driven Decision-Making

What Tools Support Strategic Portfolio Management (SPM)?

The Gartner Magic Quadrant for Strategic Portfolio Management is a comprehensive report that evaluates and ranks vendors within the Strategic Portfolio Management (SPM) market based on their completeness of vision and ability to execute.

In 2024, Clarity (Broadcom) ranks as a strong “Leader,” the best category for “Ability to Execute,” and “Completeness of Vision.”

Gartner clients can access the full report here.

Get Help with Strategic Portfolio Management (SPM)

If you are interested in implementing SPM in your organization, contact Rego today.

Rego Consulting’s team of experts have successfully guided many organizations with Strategic Portfolio Management implementations. We would gladly put our expertise to work for you.

Additional Resources

In your quest to understand Strategic Portfolio Management, we recommend the following resources:

- Free Resources for Execution-Level Value Evaluation

Take advantage of Rego’s free white papers and articles to gain insights into Strategic Portfolio Management, evaluating value at every level, OKRs, and additional helpful resources. Learn more here: https://regoconsulting.com/strategic-portfolio-management/ - Measure What Matters: How Google, Bono, and the Gates Foundation Rock the World with OKRs by John Doerr

- What is Strategic Portfolio Management (SPM)?

- Key Benefits of Strategic Portfolio Management (SPM)

- Misallocated Funds Due to Missing Strategic Portfolio Management (SPM)

- Key components of Strategic Portfolio Management (SPM):

- Strategic Portfolio Management (SPM) Critical Questions:

- How is Strategic Portfolio Management (SPM) different than Project Portfolio Management (PPM)?

- Differences between a Strategic Realization Office (SRO) and a Project Management Office (PMO)

- Why Does Strategic Portfolio Management (SPM) Matter Now?

- How to Get Started with Strategic Portfolio Management (SPM)

- What Tools Support Strategic Portfolio Management (SPM)?

- Get Help with Strategic Portfolio Management (SPM)

- Additional Resources

- About the Author: Rego Consulting